Moreover, businesses can avoid the harsh lights of compliance issues and investor skepticism with a clean, transparent ledger. Accurate contra account use also smoothes out budget forecasting and financial planning, as businesses are not caught off-guard by suddenly realized losses or overstated assets. Baking in room for bad debt, asset depreciation, and returned goods means fewer surprises and more confident stakeholders. However, that $1.4 billion is used to reduce the balance of gross accounts receivable. Therefore, contra accounts, though they represent a positive amount, are used to net reduce a gross amount. For this reason, contra accounts are primarily seen as having negative balances because they are used to reduce the balance of another account.

What Are Examples of a Contra Asset Account?

If the bond is sold at a discount, the company will record the cash received from the bond sale as “cash”, and will offset the discount in the contra liability account. By reporting contra accounts on the balance sheet, users can learn even more information about the company than if the equipment was just reported at its net amount. Balance sheet readers cannot only see the actual cost of the item; they can also see how much of the asset was written off as well as estimate the remaining useful life and value of the asset. Contra asset accounts are presented on the balance sheet as reductions from the asset accounts they relate to.

Contra Revenue Accounts

For instance, to increase asset and expense accounts, we simply record a debit and to decrease those accounts, we can record a credit. An important function of contra accounts is to preserve the historical value in the main account while presenting a reduction in the net value. By recording the offset in a separate contra account, accountants can see how much of the value in the main account has been offset.

FAQ: Navigating Common Contra Account Queries

Therefore, for these three, the debit balance actually represents a negative amount. For instance, when a company records a rebate in a contra expense account, the net expense reported on the income statement is reduced. This reduction can lead to a more favorable view of the company’s profitability, as it shows that the company is effectively managing its costs. Additionally, the use of contra expense accounts can impact key financial ratios, such as the operating margin and net profit margin, by presenting a more accurate measure of the company’s financial performance. Contra accounts play an important role in accounting by helping businesses track certain aspects of their finances more accurately.

Contra expense accounts have a natural credit balance, as opposed to the natural debit balance of a typical expense account. Therefore, a contra expense account that contains a debit balance must have a negative ending balance. A contra expense is an account in the general ledger that is paired with and offsets a specific expense account. The account is typically used when a company initially pays for an expense item, and is then reimbursed by a third party for some or all of this initial outlay. For example, a company pays for medical insurance on behalf of its employees, which it records in an employee benefits expense account. Then, when the employee-paid portion of the expense is paid to the company by employees, these reimbursements are recorded in a benefits contra expense account.

- This action reduces the total cost of goods purchased, ensuring that the expense reported on the financial statements reflects only the net cost of goods that were actually retained and used by the company.

- Key examples of contra asset accounts include allowance for doubtful accounts and accumulated depreciation.

- An example of contra equity with buying back shares or stock would be a company that has issued shares to the public.

- This depreciation is saved in a contra asset account called accumulated depreciation.

- It plays a vital role in maintaining the accuracy and transparency of a company’s financial statements.

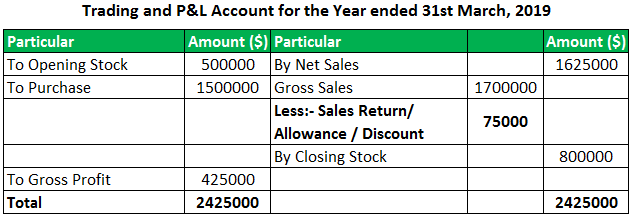

The company uses Straight-Line Depreciation to track the loss of value of the asset over time. From studying the basics of debit and credit, balance sheet accounts have a healthy balance. Home Depot reports that returns are estimated at the time of the sale based on historic returns numbers. The amount is not reported, and the net sales amount is reported on the income statement. And let’s not forget the all-important Allowance for Doubtful Accounts, acting as a financial crystal ball that estimates the portion of accounts receivable that might just turn into fairy dust. Businesses benefit by forecasting more realistic revenue figures, which helps in strategic planning and maintaining investor confidence.

This is important for accurate financial reporting and compliance with… Contra accounts help maintain the accuracy of financial records, provide transparency in reporting, and allow for proper tracking and analysis of specific transactions or events. Utilizing contra accounts in financial accounting has several significant advantages that enhance financial transparency and enable more effective financial management.

We will define what contra accounts are, the types of contra accounts and provide examples to illustrate. Each account in a general ledger will be designated debit or credit accounts depending on whether they’re categorized as assets, liabilities, revenues or expenses. Overall, while maintaining contra accounts may require additional effort, the benefits they offer contra expense account examples in terms of financial transparency and accountability make them an essential tool in accounting. In addition, templates for contra account journal entries help ensure consistency and accuracy in recording transactions across the board. With the right tools and the wisdom of the community, managing contra accounts becomes a seamless part of your accounting routine.

The net effect of the two accounts is a reduced total benefits expense for the company. To account for depletion, an Accumulated Depletion account is created so that it can serve as a contra account for the parent Fixed Asset account. By creating Accumulated Depletion account, companies can reflect the reduction of the natural resource asset and the overall depletion costs in a more accurate way. By properly managing depletion accounting, companies in these industries can better track and allocate the costs and value of their natural resources.

The mechanics of contra expense accounts involve debits and credits, similar to other accounts in double-entry bookkeeping. When an expense is initially recorded, it is debited to the relevant expense account. If a reduction or rebate occurs, a credit is made to the contra expense account, which offsets the original expense. This method ensures that the financial statements reflect the net expense, rather than the gross amount, providing a more precise financial picture. It carries a credit balance and is linked to the fixed asset account, which carries a debit balance. The accumulated depreciation account is designed to reduce the carrying value of the fixed asset account when depreciation is recorded at the end of each period.

In other words, contra revenue is a deduction from gross revenue, which results in net revenue. Angela Boxwell, MAAT, is an accounting and finance expert with over 30 years of experience. She founded Business Accounting Basics, where she provides free advice and resources to small businesses. Contra accounts are a little tricky to think about when you are first starting out.