The equity section of the balance sheet is where the shareholder’s claims to assets are reported. The main contra equity account is treasury stock, which is the balance of all stock repurchased by the company. When a company repurchases shares, it increases the fractional ownership of all remaining shareholders.

Tools and Resources for Contra Account Management

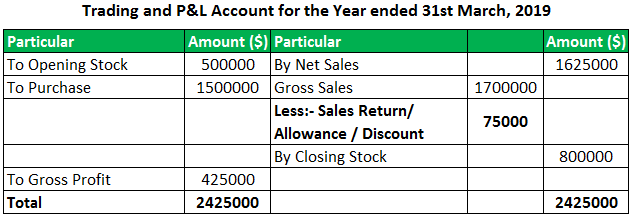

This also ensures accurate financial statements, which is essential for meeting regulatory requirements and maintaining the trust of stakeholders. Businesses experience a world of benefits from maintaining accurate contra account records. By reflecting the true health and value of assets, liabilities, and equity, they support a realistic assessment of financial standing. Accurate records prevent overstatement of assets and revenues, thereby aiding in sound decision-making; imagine knowing exactly how much those accounts receivable are truly worth, beyond optimistic estimations. The revenue contra accounts Sales Returns, Discounts and Allowances are subtracted from the main Sales Revenue account to present the net balance on a company’s income statement.

What are the Five Types of Contra Accounts?

The company has a contra asset account for accumulated depreciation expense and a separate asset account for equipment cost. The contra asset account would be used to offset the equipment account on the balance sheet. A liability recorded as a debit balance is used to decrease the balance of a liability. Contra Liability a/c is not used as frequently as contra asset accounts. It is not classified as a liability since it does not represent a future obligation.

Contra Liability Accounts

Upgrade your productivity and performance with ready-to-use accounting templates designed to streamline contra account management. Optimizing your handle on contra accounts doesn’t end with just understanding them; it’s about mastering the tools and techniques to manage them effectively. Enrich your expertise by diving into online courses that dissect advanced accounting concepts, many of which come with coveted CPE credits to boot.

Allowance for Doubtful Accounts

Contra revenue accounts reduce revenue accounts and have a debit balance. Contra asset accounts include allowance for doubtful accounts and accumulated depreciation. Contra asset accounts are recorded with a credit balance that decreases the balance of an asset.

- By offsetting specific expenses, these accounts ensure that the reported figures more accurately reflect the company’s net expenditures.

- The points below explain the importance of passing a contra account entry.

- For the past 52 years, Harold Averkamp (CPA, MBA) hasworked as an accounting supervisor, manager, consultant, university instructor, and innovator in teaching accounting online.

- Expense accounts are technically contra equity accounts because they are linked to another equity account, revenue, and maintain an opposite balance.

Diving into Different Types of Contra Accounts

In a default situation, the amounts are offset, and the receivable value is lower or nonexistent. Contra accounts help provide more accurate financial information by separating certain items and highlighting their impact on the overall financial position. In footnote 3, the company reports, “Net property and equipment includes accumulated depreciation and amortization of $25.3 billion as of August 1, 2021 and $24.1 billion as of January 31, 2021.” When the company pays the cost of having the flyer printed, a journal entry is done. The purpose of the Accumulated Depreciation account is to track the reduction in the value of the asset while preserving the historical cost of the asset. Taking the example of CCC again, the company has $50,000 in accounts receivable at year-end of December 31.

In the above example, the debit to the contra liability account of $100 lets the company recognize that the bond was sold at a discount. Inscrutable Corporation offers long-term disability insurance to its employees under an arrangement in which it pays for the insurance, and then participating employees reimburse it for half of this cost. In the first month of the arrangement, the company pays the insurer $10,000, which Inscrutable records in a long-term disability insurance expense account. It then records $5,000 of contra expense against this account, which is derived from deductions taken from employee pay.

For the ultimate learning experience, consider a Full-Immersion Membership that offers unlimited access to an extensive collection of templates, courses, and tools. It’s the ideal platform for those looking to take their skills—and their business’s financial clarity—to the next level. For the past 52 years, Harold Averkamp (CPA, MBA) hasworked as an accounting supervisor, manager, consultant, university instructor, and innovator in teaching accounting online.

In the realm of accounting, various techniques are used to ensure financial statements provide an accurate and comprehensive view of a company’s financial health. One such method is the use of contra accounts, a type of account that directly correlates and offsets contra expense account examples a related account. In finance, a contra liability account is one that is debited for the explicit purpose of offsetting a credit to another liability account. In other words, the contra liability account is used to adjust the book value of an asset or liability.

You could explore comprehensive webinars and workshops focused on the nitty-gritty of contra accounts. Those who are struggling with recording contra accounts may benefit from utilizing some of the best accounting software currently available. The purpose of the Sales Returns account is to track the reduction in the value of the revenue while preserving the original amount of sales revenue. In order to keep the accounts receivables as clean as possible with their historical values, we will use this contra account called allowance for doubtful accounts. There is the existence of contra accounts in accounting which are accounts that have the purpose of decreasing the value of another specific account if the two accounts are netted or summed together. A contra account is an account used in a general ledger to reduce the value of a related account when the two are netted together.

There are four key types of contra accounts—contra asset, contra liability, contra equity, and contra revenue. Contra assets decrease the balance of a fixed or capital asset, carrying a credit balance. Contra liabilities reduce liability accounts and carry a debit balance. Contra equity accounts carry a debit balance and reduce equity accounts.